Protection from Fraud and Scams

As part of National Safeguarding Adults Week, we’re sharing information to help protect yourself and people who are vulnerable. Protecting your money and your information online has never been so important. The pandemic has given lots of fraudsters opportunities to target people in new ways, so being aware of potential scams will keep yourself and your money safe.

According to Barclays, “just months into the pandemic, the UK’s National Fraud Intelligence Bureau (NFIB) reported a disturbing trend in coronavirus-related fraud. Between 1st February 2020 to 30th March 2020, there had been 105 reports to Action Fraud with total losses reaching nearly £970,000.”

How scammers scam

Scammers will use every tool in their arsenal to get personal information from you. You might think you’d spot a fake email (‘phishing’), or a phone call from a bogus company (‘vishing’), but scammers are masters of manipulation and have technical knowledge that can seem very convincing.

According to Barclays, the scammer’s ‘toolkit’ includes:

- Creating a sense of authority– we tend to comply with authority figures rather than follow our conscience

- Creating a sense of consequence– we tend to be loss-averse and will seek to avoid negative consequences

- Creating a sense of urgency– we make worse decisions under stress and time pressure

- Appealing to our vanity or greed– we struggle to resist opening an email attachment that promises potential rewards

If you receive a message or phone call from someone you haven’t heard of and can’t verify their credentials, don’t give them any of your personal or banking details. The person may say it’s urgent or that there’s a reward in it for you, but if you can’t trust them and they can’t provide proof that it’s real, the likelihood is that they’re trying to scam you- it’s better to be safe than sorry.

Types of scam

There are many different types of scams people will use to try and convince you to share information, including your bank details. These include:

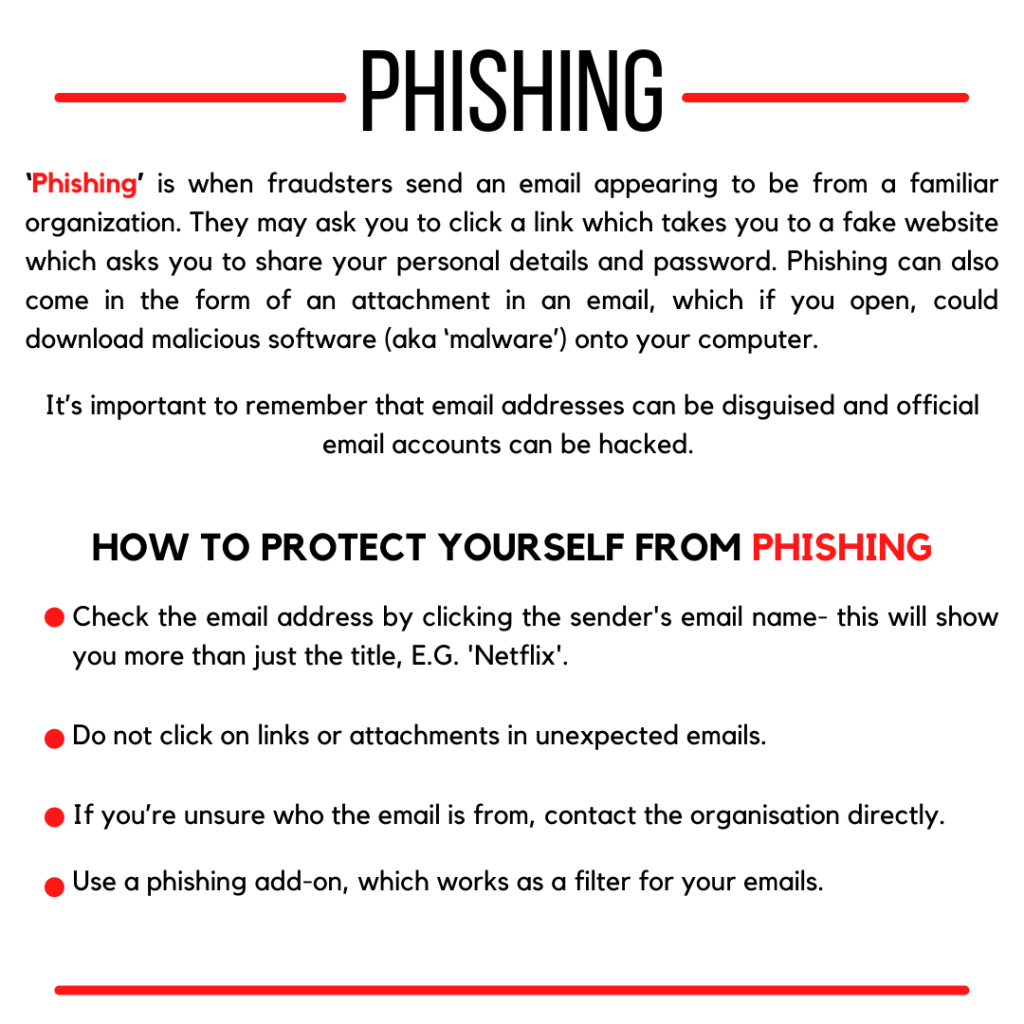

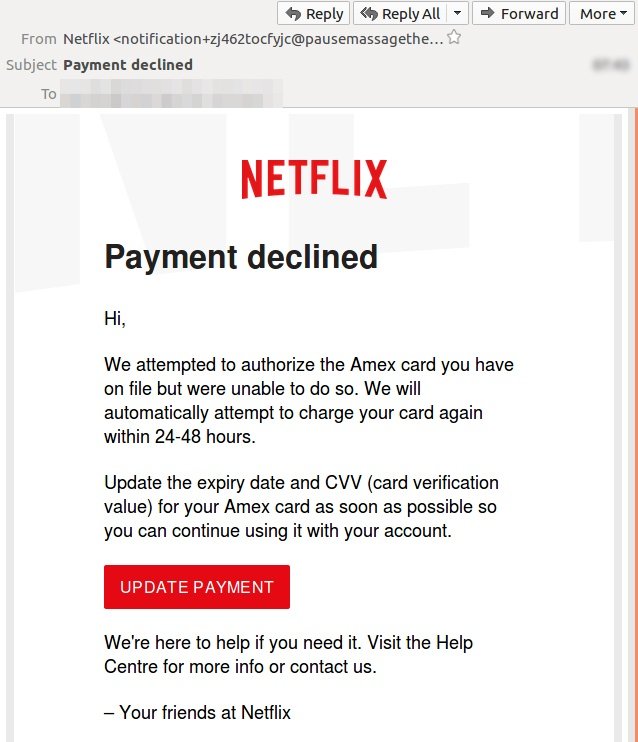

- ‘Phishing’: This is when fraudsters send an email appearing to be from a familiar organization. They may ask you to click a link that takes you to a fake website and asks you to share your personal details and passwords. Phishing can also be through email attachments, which if you open could download malicious software (aka ‘malware’) onto your computer. The image below is an example of phishing from someone claiming to be Netflix.

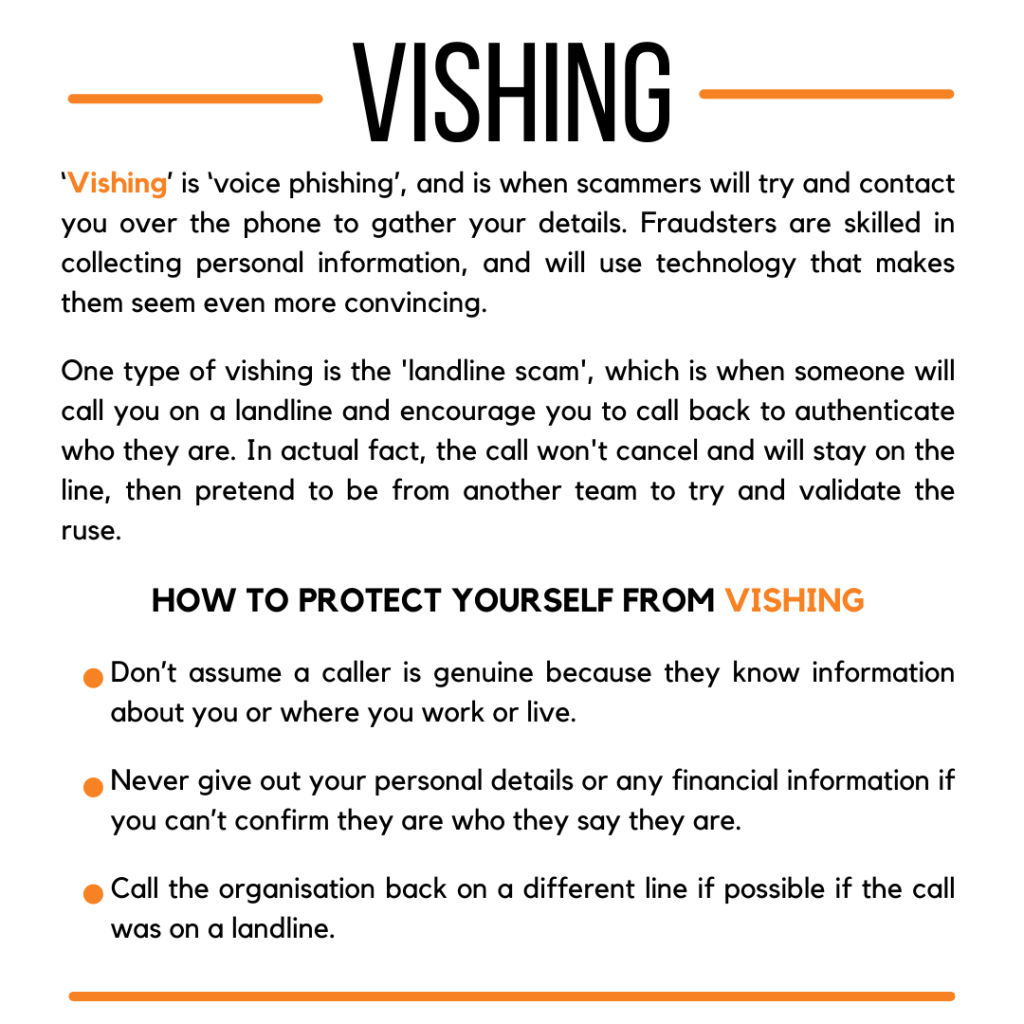

- ‘Vishing’: This is ‘voice phishing’, and means that scammers will try and contact you over the phone to gather your details. An example of this would be a call from someone who says they “believe you have been involved in a car accident that wasn’t your fault” and then ask you for details which they will mine for your data.

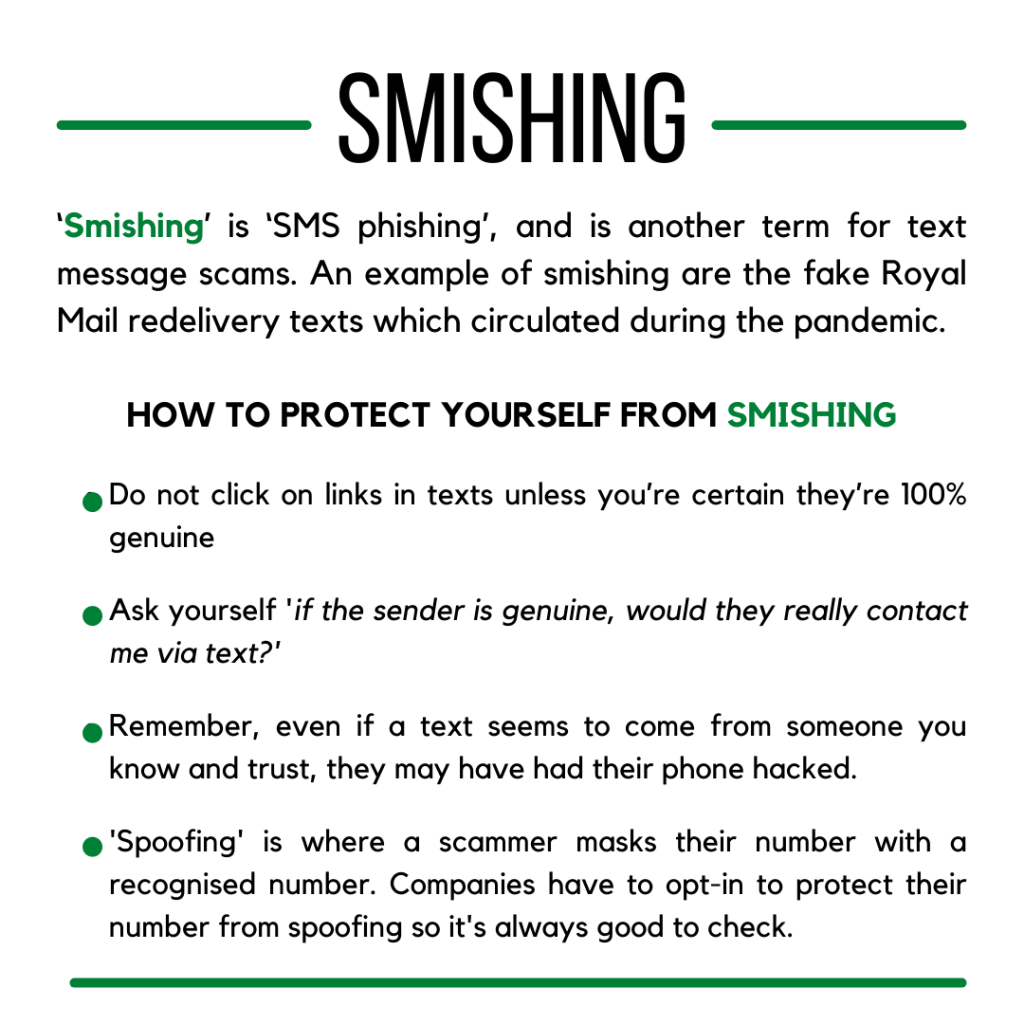

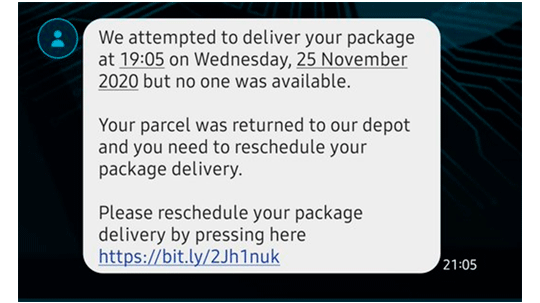

- ‘Smishing’: This is ‘SMS phishing’, and is another term for text message scams. Recently there was a flood of people receiving fake texts and emails from ‘Royal Mail’, saying: “Your parcel has been returned to the depot after a failed delivery attempt. Your redelivery can be arranged via this link:”. The link takes you to a realistic looking Royal Mail website, asking you to input your personal details such as your address and phone number, in order to steal your identity.

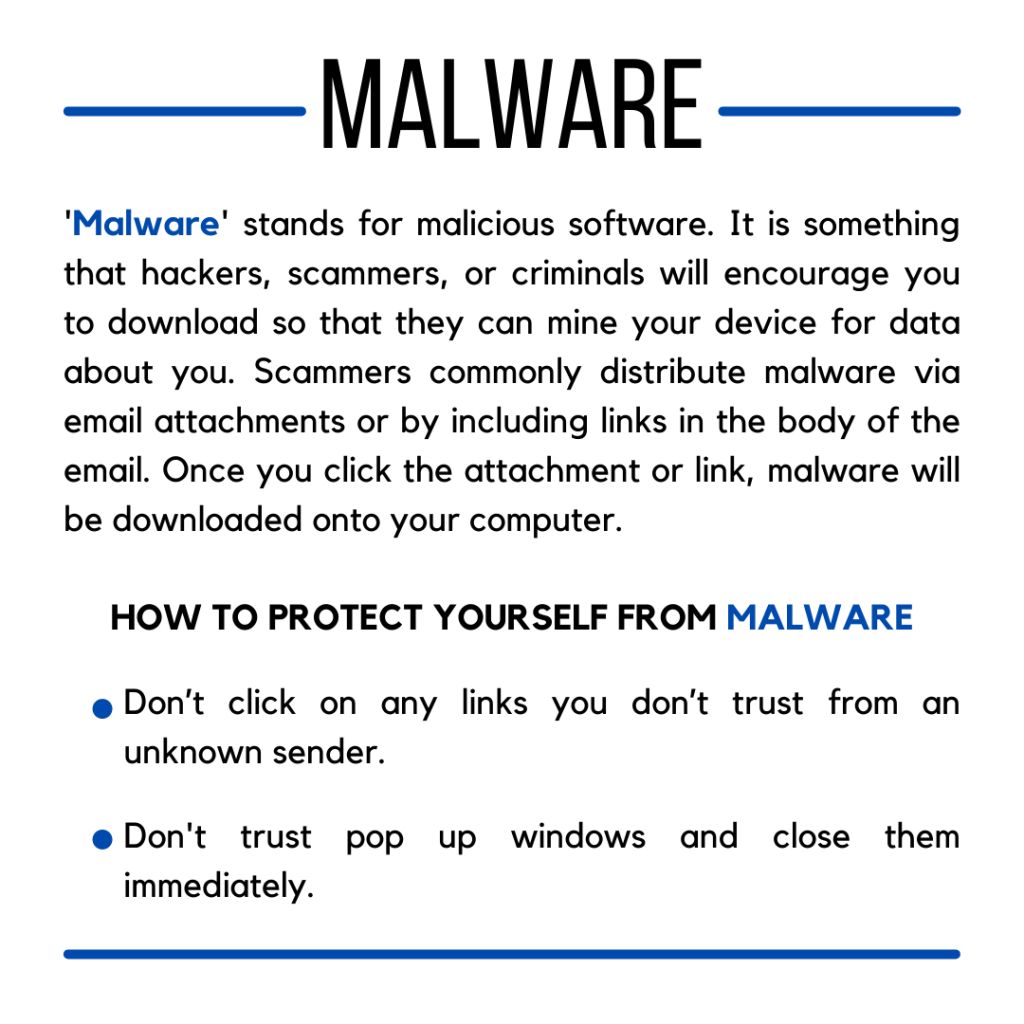

- Malware: This term is short for ‘malicious software’, and is something that hackers or scammers will encourage you to download so that they can mine your device for data about you. A computer virus is a common type of malware, and sometimes it can stop you from using your computer completely.

- Landline scams: This is when someone tries to ‘vish’ you. To try and prove their authenticity, they will ask you to hang up the phone so you can call them back to prove they are who they say they are. In actual fact, if they don’t hang up too they will stay on the line and pretend to be from another team at the organisation to mask the ruse.

If you are scammed

If someone has conned you out of your money, hacked your email or social media accounts or added malware to your computer, the first thing to know is that it is not your fault and that this is unfortunately common. Criminals continue to develop clever techniques and it’s becoming more and more difficult to protect yourself against them.

Check out the work from the following organisations who have lots of articles on how to protect yourself from scams:

- The Financial Ombudsman

- Citizens Advice

- Age UK

- The Met Police

- Money Saving Expert

Remember, don’t click links you’re unsure about, even if they seem like they’re from your friendly local care provider!

Protecting yourself, your details, and your finances online is really important. The mental toll financial scams and personal hacks take can be huge. If you realise that someone has stolen your details or committed fraud in your name, remember that it’s not your fault. Money can be recovered and scammers can be caught- they are the ones in the wrong here, not you.

If you are a member of staff at Creative Support who is experiencing stress or poor mental health because of these kinds of scams, speaking to a mental health professional can help you manage your mental wellbeing. One way to do this is through our Employee Assistance Programme Health Assured, which can also provide financial advice and is a great resource that is free and easy to use.

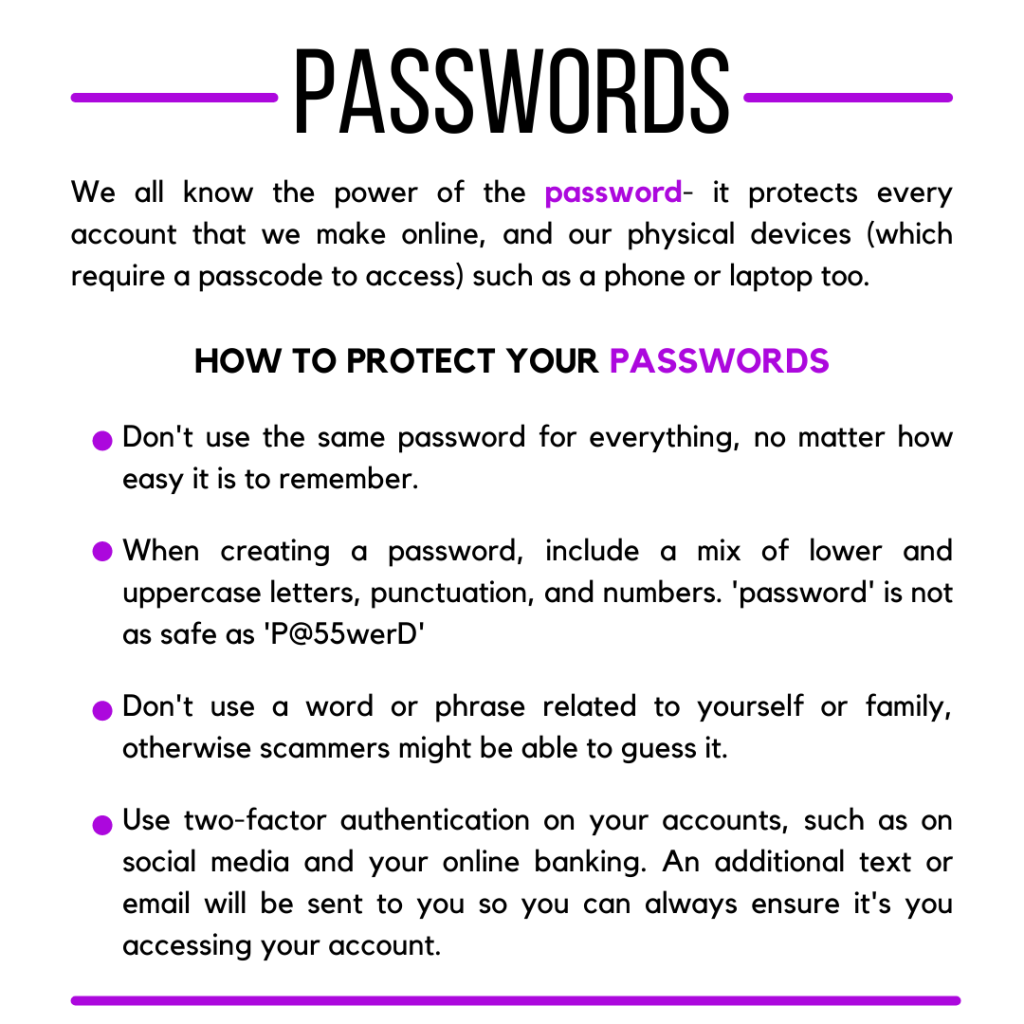

Check out our tips on how to protect yourself from some of these types of scams in the picture boxes below.